Funding Intelligence &

Opportunity Mapping

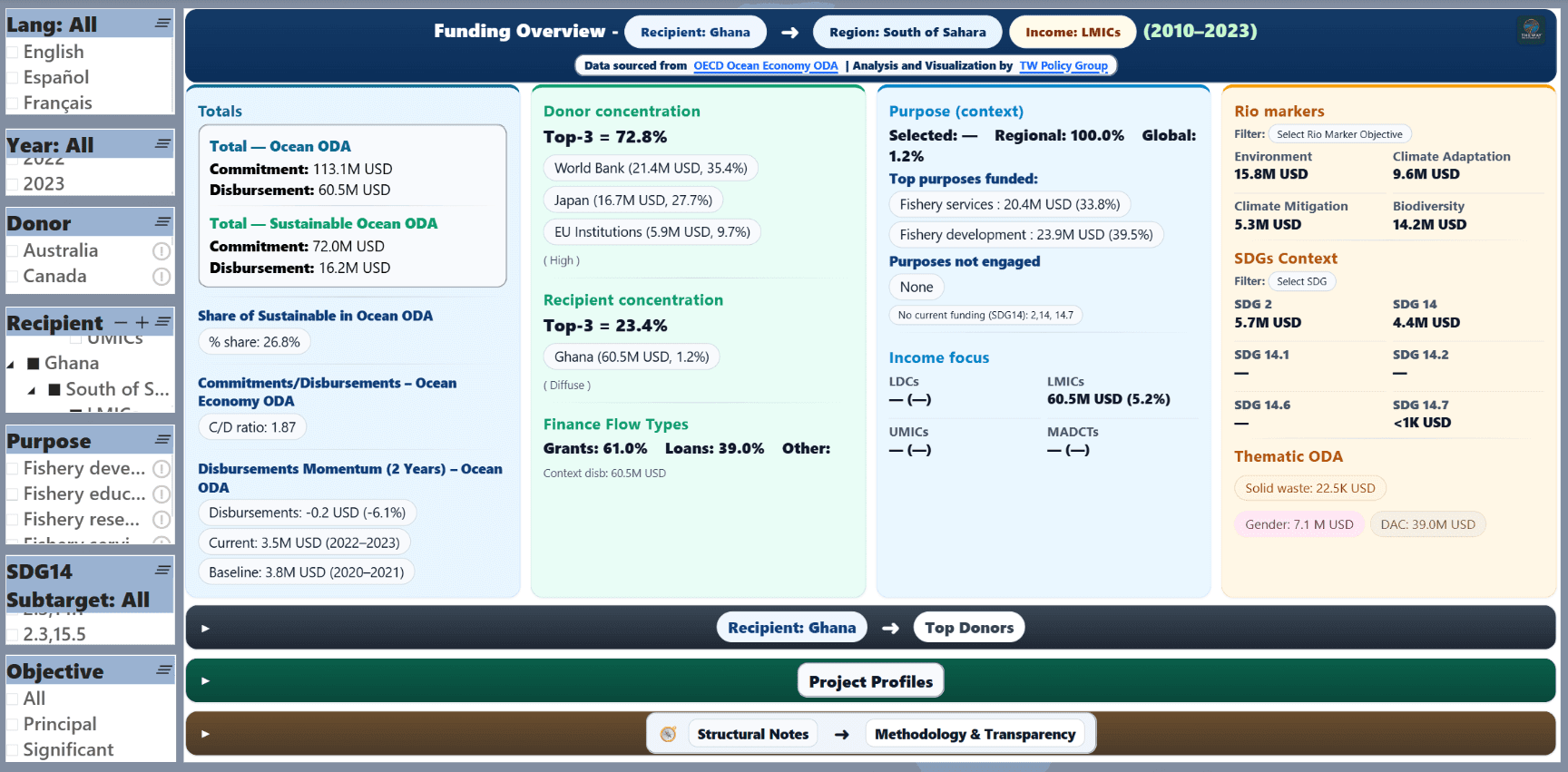

We support governments, businesses, and development partners in agriculture and fisheries to identify and secure targeted funding —spanning ODA grants, loans, and equity instruments. Using tools like Python, Power BI, Excel, and Tableau, we analyze cross-sector funding flows and visualize development finance trends in real time—helping you track opportunities early and navigate complex mechanisms confidently.